June 2, 2016

ABSTRACT

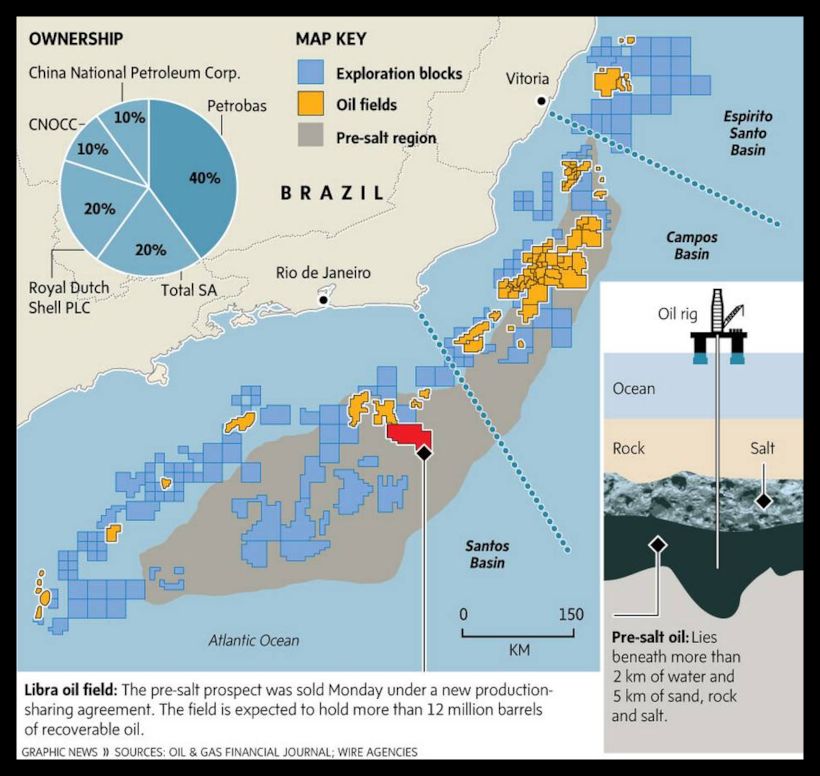

Brazil’s petroleum fiscal structure is one of the most

complex petroleum systems at the world level. The country has a petroleum

regulatory framework based on concessionary agreements, production sharing

contracts (P.S.C.s), and offshore areas where Petrobras, Brazil’s semi-public

multinational petroleum corporation, has for a period of 40 years the right to

extract up to 5 billion barrels of oil equivalent (b.o.e.). This paper consists

of two parts. In the first part, after a description of Brazil’s current oil

production, it’s developed an analysis of Brazil’s petroleum fiscal structure.

In the second part, the paper delineates a five-step methodology in order to

assess the economic viability of the Libra oil field P.S.C. (additional

research is necessary in order to collect all the data required by the five-step

model), and it presents some preliminary considerations concerning the economic

viability of the Libra P.S.C.

PART I —

Brazil’s Oil Production (E.I.A. Data for 2014)

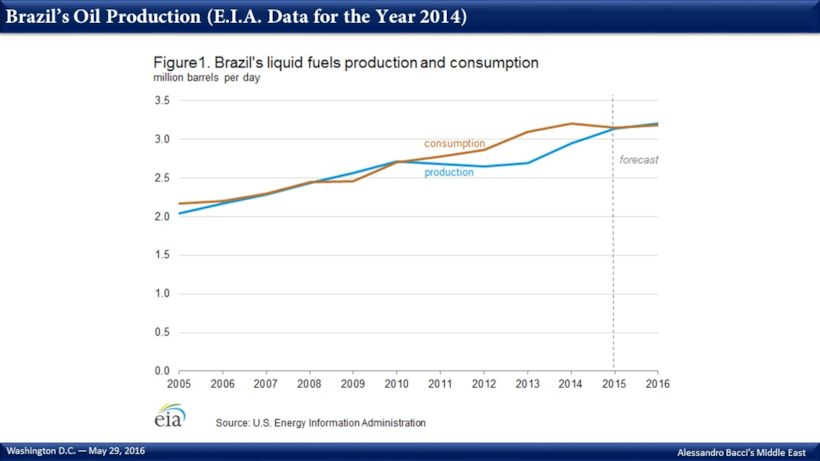

In 2014, Brazil produced 2.95 million barrels per

day (bbl/d) of petroleum and other liquids. This quantity makes Brazil the

world’s 9th-largest producer (in specific, the third in the Americas

after the U.S. and Canada). These 2.95 million bbl/d are divided in 2.2 million

bbl/d of crude oil, 551,000 bbl/d of biofuels, and the remainder as condensate

(a low-density, high-A.P.I. gravity liquid

hydrocarbon that generally occurs in association with natural gas) and

natural gas liquids (N.G.L.s, i.e., ethane,

propane, butane, isobutane, and pentane). The state of Rio de Janeiro produced

1.54 million bbl/d in 2014, so it approximately accounts for 68.4 percent of

Brazil’s total production.

Year after year, Brazil

is increasing its crude oil production from offshore oil deposits in the

pre-salt layer; in April 2015 pre-salt crude oil made up a quarter of Brazil’s

total output. And in July 2015, when new oil fields in the Santos Basin came

onstream, oil production from the pre-salt deposits reached 865,000 bbl/d. The

production of crude oil from the pre-salt deposits has consistently increased

over the last eight years. In fact, when it started in 2008, the production was

only around 0.4 million bbl/d.

Notwithstanding the

positive results of the last years, Brazil consumes more petroleum and other

liquid fuels than it is able to produce. For instance, in 2014, Brazilian

demand for crude oil and other liquid fuels was 3.2 million bbl/d (3.0 million

bbl/d in 2013). According to the Energy Information Administration (E.I.A.),

it’s possible that already in 2016 production could exceed consumption. At the

same time, it’s worth noting that, in addition to the current low oil prices,

this forecast is highly uncertain as well in light of the high corporate debt

and the corruption scandal involving Petrobras, which is Brazil’s semi-public

multinational petroleum corporation. These three factors may adversely affect

future development and current production. Petrobras is presently under

investigation in Brazil and the U.S. for bribery and money laundering. As

further proof of the fact that there could be difficulties achieving a complete

self-reliance any time soon, in 2014 Petrobras invested $27.4 billion, which

represented a 17 percent reduction in comparison to the value invested in 2013.

The current financial difficulties are a turning point because, until 2007,

Petrobras’ operating cash flows had always been sufficient to pay all the

capital expenditures; and the company had never needed to raise new equity

capital over the previous 30 years. For more information about Petrobras and

corruption, please read the four slides “Operation Car Wash” below.

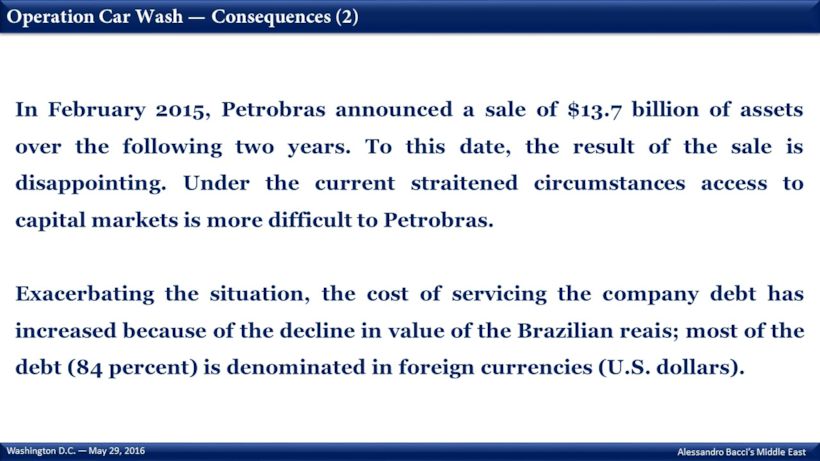

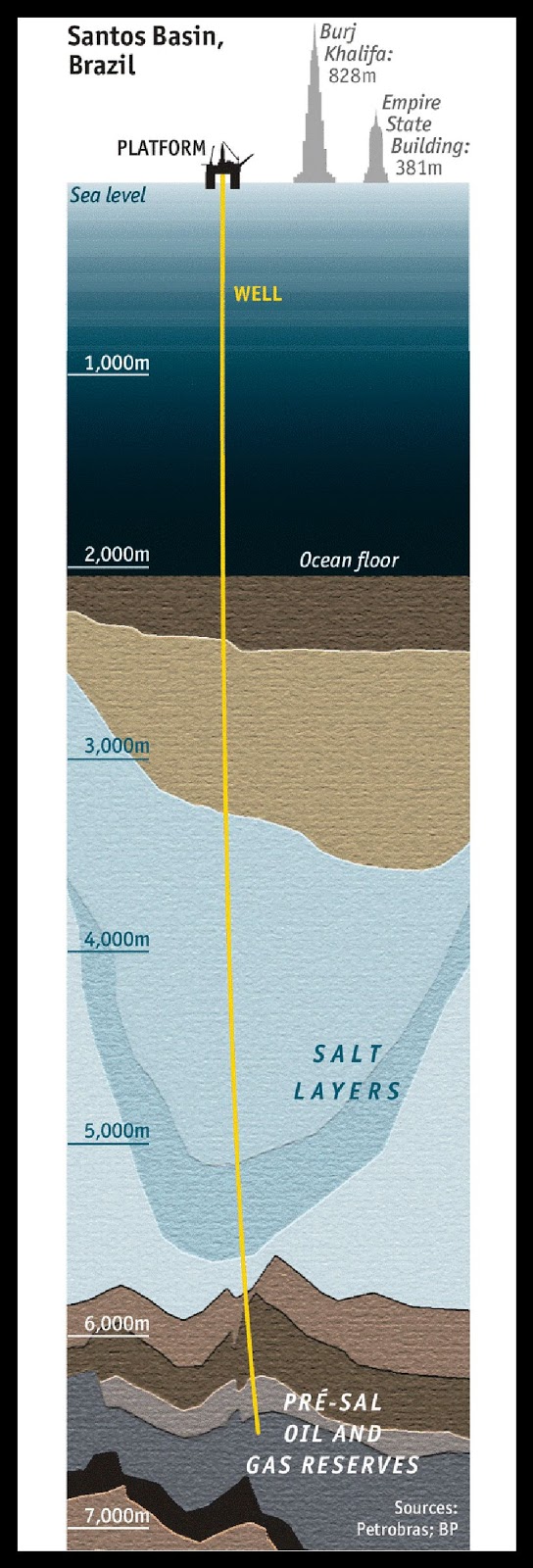

In Brazil, the new

most-promising frontier area for oil exploration and production is represented

by the offshore pre-salt oil fields running for about 800 km at approximately

250 kilometers from Brazil’s southeastern coast. This pre-salt oil is located

at a depth of 7,000 meters: 2,000 meters of Atlantic Ocean water and 5,000

meters of a thick layer of rock and salt; this layer of salt complicates

extraction but has conserved the hydrocarbons without leakage. All these

characteristics make extraction quite expensive and requiring top-notch

offshore production expertise. Brazil’s pre-salt oil has an A.P.I. grade of 27

degrees coupled with a low sulfur composition.

In 2005, Petrobras

drilled exploratory wells near the Tupi field (250 kilometers off the coast of

Rio de Janeiro), today called the Lula field, and discovered hydrocarbons below

the layer of salt. Then in 2007, a consortium of Petrobras, BG Group, and

Petrogal drilled still in the Tupi field and discovered an estimated 5 to 8

billion barrels of oil equivalent (b.o.e.), at 18,000 feet below the ocean

surface. Additional exploration showed that pre-salt hydrocarbon deposits

should extend through the Santos, Campos and Espirito Santo offshore basins.

Some pilot projects started in 2009 and 2010. All the pre-salt areas currently

in the development phase have not been competitively granted to Petrobras.

Then, in October 2013, the government of Brazil conducted its first pre-salt

licensing round for the Libra field, which should hold, according to initial

estimates, between 8 to 12 billion barrels of recoverable reserves.

PART I — The Regulatory Framework — The Concession Regime

The Brazilian upstream

oil and gas sector was opened to private companies in 1997, when Law 9,478

(a.k.a. the Oil Act) was promulgated. In fact, before the publication of this

law, the upstream sector was completely under the monopoly of Petrobras,

originally a state-owned company (created in 1953) that later became

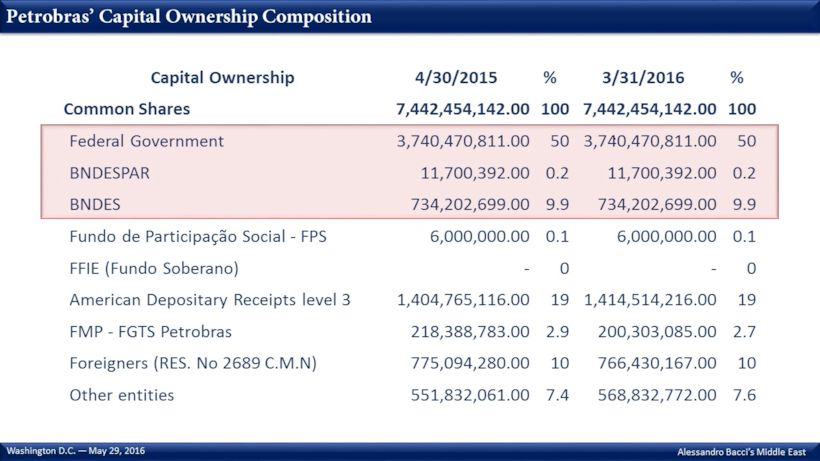

majority-owned by the state. Today, the government directly owns 50.3 percent

of Petrobras’ common shares (those with voting rights), while the Brazilian

Development Bank and Brazil’s Fundo Soberano (a sovereign wealth fund, S.W.F.)

control a 10 percent share; adding up all the three government-related

components, the government has around a 60 percent ownership (direct and

indirect).

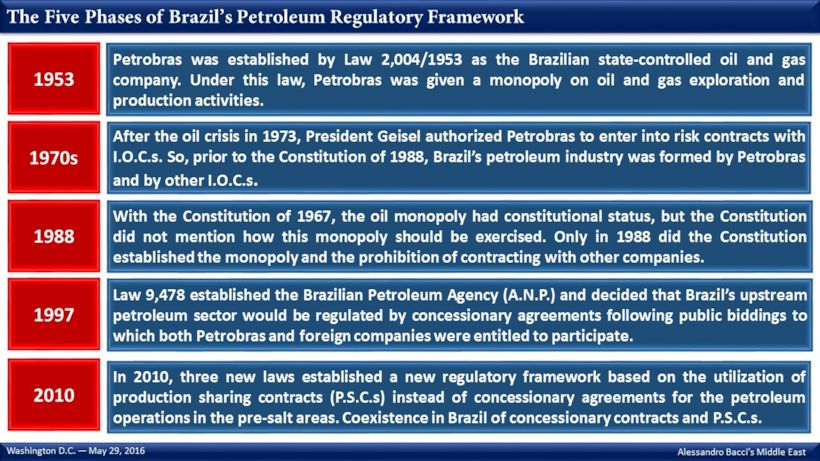

When Petrobras was

established, it was given the monopoly on oil and gas exploration and

production activities. But, after the oil crisis in 1973, President Geisel of

Brazil, authorized Petrobras to enter into risk contracts with I.O.C.s. So,

prior to the Constitution of 1988, which closed Brazil’s upstream sector to

I.O.C.s, Brazil’s petroleum sector included Petrobras as well as several

I.O.C.s (among them Shell, Exxon, Texaco, BP, Elf, and Total).

Already the Constitution

of 1966 had given the petroleum monopoly constitutional status, but it hadn’t

mentioned how this monopoly should have been exercised. Then, the Constitution

of 1988 introduced some more restrictive provisions effectively establishing

the monopoly and the prohibition of contracting with other companies.

Article 177 of the Constitution of 1988, expressly prohibited I.O.C.s from

acting in Brazil with reference to the exploration of oil, gas, and other

hydrocarbons fluids. Today, Article 177 of

the Constitution, as amended in 1995, still affirms that the prospecting, exploration

and production of petroleum are a monopoly of the federal government, but it

also permits the government to contract state-owned as well as private

companies for the execution of those activities.

Law 9,478 created the

Brazilian Oil Agency (A.N.P.), which is the regulatory body in charge of the

supervision and regulation of the petroleum sector. At the same time, this law

decided that Brazil’s upstream petroleum sector would be regulated by

concessionary agreements following public biddings to which both Petrobras and

foreign companies were entitled to participate. The basic requirement is that

companies and/or consortiums meet the legal, technical and financial

requirements established by the A.N.P. The exploration risk pertains to the

concessionaire, which has ownership of the produced oil and is also entitled to

export it; the concessionaire has to pay taxes and royalties.

The acquisition of the

exploration and production rights may be direct via participation in the

bidding rounds organized by the A.N.P. or indirect via the acquisition of a

participation interest in a block previously assigned to other companies. The

indirect option requires the approval of the A.N.P. The petroleum areas where

Petrobras was already working before Law 9,478 were left to the company (Round

Zero of concession). Then, in 1999 the A.N.P. organized Round 1, which indeed

was the actual opening of the Brazilian petroleum sector – 11 companies won

concessions agreements. Over the subsequent years, until 2008, the A.N.P. held

other 10 concessionary rounds. All these rounds gave positive results, and,

between 2001 and 2011, Brazil increased its oil production by almost 1 million

bbl/d to 2.2 million bbl/d and more than doubled its gas production to 16.7

billion metric cube. In the last three years, Brazil has organized three other

bidding rounds for concession agreements, two in 2013 and one in October 2015.

The last one (the 13th round), held in October 2015 and offering 266

oil blocks fell significantly short of the expectations because the country

managed to sell only 37 blocks. Almost 40 companies had qualified, but then

only 17 submitted bids (and of these 17, 11 were Brazilian). As possible reasons

for the bad results, it’s probable worth mentioning the low oil prices and

Petrobras’ decision not to participate in the bidding round.

In order to choose the

winning bidders, the A.N.P. uses a formula that encompasses the following three

criteria (variable with reference to their numbers and percentages according to

the specific bidding round):

- The amount of the signature bonus

- The minimum exploratory program

- The local content offered by each bidder

Local content

requirement is a very important element of every petroleum contract in Brazil.

It consists of the obligation for the oil companies to give preference to

Brazilian suppliers and to reach a minimum percentage of its exploration and

development expenditures using Brazilian suppliers. In order not to permit to

inefficient companies to be awarded contracts, local suppliers have preference

only when there is an equivalence between their price, delivery timeframe and

quality, and those of foreign suppliers. These local content policy

requirements exist since Round Zero, but after 2005 the controls are more

serious.

The oil companies have

to pay the government:

- The signature bonus (immediately when winning the bidding round)

- A retention fee proportional to the size of the concession area

- A 10 percent royalty calculated on the production of oil and gas

- A special participation for blocks that have high levels of production or profitability

- Income tax

The ownership of the oil

and gas produced becomes property of the concessionaire once the hydrocarbons

pass through the measurement point.

A Brazilian concession

is composed of two distinct phases:

- The Exploration Phase — It cannot last more than 7 years, which can be divided into two sub-periods; the second sub-period is optional. Over the course of this phase, the concessionaries must perform the minimum exploratory program (seismic activities and possibly drill at least one exploratory well). This phase includes the appraisal of a discovery (of course, if a discovery does occur).

- The Production Phase — It usually may last up to 27 years, and it starts after completion of the minimum exploratory program. Production begins after a declaration of commerciality, which follows the completion of the appraisal of the discovery.

According to Law 9,478,

the assignment or transfer of a concession, fully or partially, may occur on

condition that the assignee covers the technical, financial and legal

requirements set forth by the A.N.P. in the concession contract and previously

in the bidding round.

After the promulgation

of Law 9,478 (the Oil Act), in order to obtain the necessary economic

resources, Petrobras sought partners via farm-out agreements and project

financing structures. In practice, with farm-out agreements Petrobras sold a

participatory interest in areas that it had obtained via a concession

agreement. In Brazil, project financing structures have played a very important

role at the end of 1990s.

In specific, at that time,

Petrobras desperately needed cash, but its possibility of raising debt via

normal debt instruments was strongly curtailed by Brazil’s agreements with the

International Monetary Fund (the I.M.F.). Similarly, the federal government had

its hands tied as for providing Petrobras with new funds. So, it was developed

an off-balance mechanism (for instance, in relation to the Marlim field) in

order that neither Petrobras’ leverage ratio, nor the federal government’s

public debt limit was affected. It was created a joint venture between

Petrobras and an S.P.C. (special purpose corporation). The joint venture had no

interest in the concession, but it was responsible for raising debt to pay for

the asset to use in a specific field. Later, when revenues started, the S.P.C.

would receive for instance 30 percent of the field’s revenues. Today,

reserve-based lending is another possibility. It consists of a type of

financing in which a loan is secured by the oil and gas undeveloped reserves of

a borrower. The facility is subsequently repaid using the proceeds deriving

from the sales of the producing fields.

PART I — The Regulatory Framework — The Production

Sharing Contracts (P.S.C.s)

After relevant

legislative debates and thanks to the pressure of the Workers’ Party, in 2010,

the Brazilian Congress established a new regulatory framework based on the

utilization of production sharing contracts (P.S.C.s) instead of concessionary

agreements for the petroleum operations in the pre-salt areas.

The framework is based

on the following three laws:

- Law 12,276 of 2010, regarding the “onerous assignment”, i.e., the direct grant of areas to Petrobras with the aim of capitalizing Petrobras.

- Law 12,304 of 2010, authorizing the establishment of a new state-owned company called Empresa Brasileira de Administraçáo de Petróleo e Gás Natural (P.P.S.A.), whose main roles are to manage and supervise P.S.C.s and to represent the government in project operating committees.

- Law 12,351 of 2010, a.k.a., the Pre-Salt Law, defining the Brazilian P.S.C.s for the pre-salt areas and for other strategic areas of Brazil.

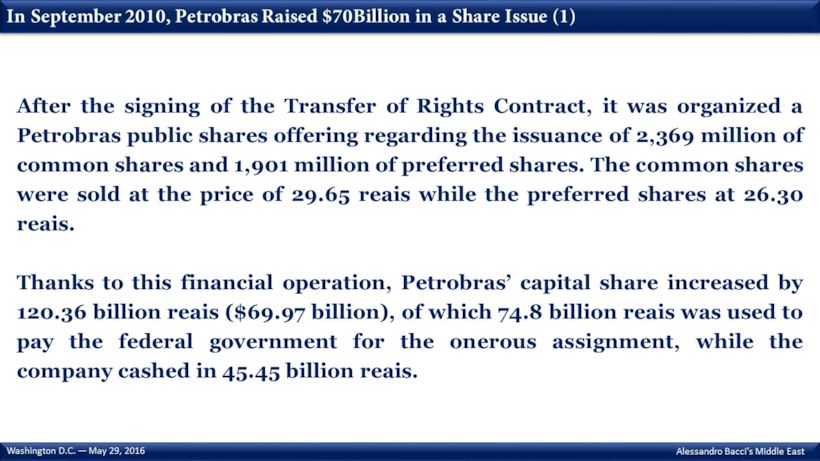

As a result of the three

new laws, in Brazil there are now two different legal frameworks for the petroleum

sector, i.e., concessions and P.S.C.s, and geography (the location of the

petroleum field) is the real parameter deciding which one of the two regimes

has to apply. It’s debatable whether the onerous assignment may be considered a

third framework. In fact, thanks to Law 12,276, in September 2010, the Federal

Union passed to Petrobras the right to explore for 40 years up to 5 billion

barrels of oil equivalent in six designated pre-salt areas and one contingent

area (Transfer of Rights Contract).

The idea and the

expectations of large petroleum reserves located in the pre-salt areas, pushed

many Brazilian states to discuss the way oil and gas royalties were distributed

within the federation. Under the push of the non-producing states, Law 12,734,

which improved the position of the non-producing states to the detriment of the

petroleum-producing states, was passed in November 2012. The constitutionality

of this law was immediately challenged by some of the producing states, and the

Federal Supreme Court granted an injunction suspending the effects of the law

until its final decision — still today this law is only partially applied.

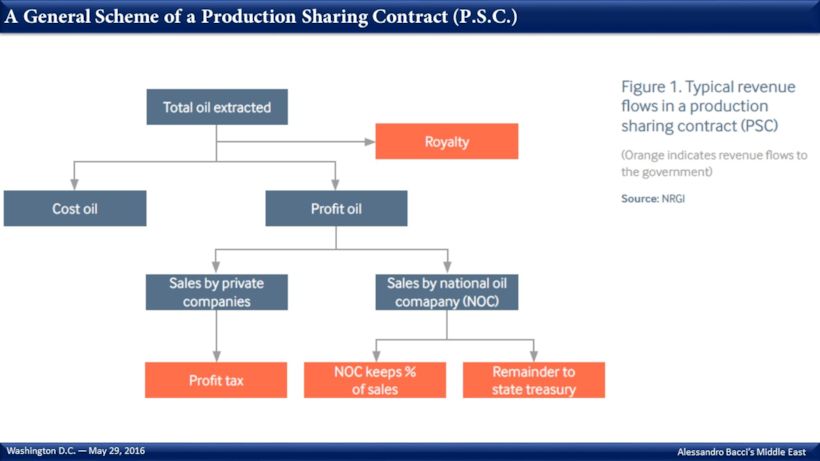

The Brazilian P.S.C.s

are classic P.S.C.s where the contractor will carry out and pay for the

exploration at its own risk and expense.

All the exploration

activities will be completely paid for by Petrobras and its joint-venture

partners. Later, in case of a commercial discovery, the contractor will be

reimbursed for the exploration and production costs, the so called Cost Oil

(certified by the P.P.S.A.), and will obtain a percentage (as per the contract)

of Profit Oil.

PROFIT OIL = Total Revenues – Royalties — Cost Oil

Article 4 of Law 12,351 stipulates

that Petrobras is the sole operator of the P.S.C.s (all phases included). The

award of the P.S.C.s may be done directly to Petrobras (no auction) or to a

consortium of private companies via a bidding procedure. If it is chosen the

second procedure, Petrobras will have a minimum participating interest of 30

percent in every single block in the pre-salt and the strategic areas. This

means that it will be the remaining 70 percent to be awarded to other companies

under a competitive bidding round. The winning companies will form a consortium

with Petrobras (and P.P.S.A.). If Petrobras deems it relevant to its business

strategy, it may compete by itself or under a joint bidding arrangement to

increase its 30 percent mandatory share to up to 100 percent.

P.P.S.A. will not take

any risks nor make any investments, but, on behalf of the government, it will

participate in the P.S.C.s; chair the operating committee with a 50 percent

vote and a veto power; administer the contracts; after contacting trading agents

manage the commercialization of the federal government’s petroleum produced in

the pre-salt and strategic areas; and represent the federal government in the

unitization procedures. Occasionally, the federal government has the right to

directly participate in the investment (in addition to Petrobras). In such a

case, the government will assume the risks in proportion to its share and later

will be entitled to the corresponding cost oil and profit oil. It should be

underlined that, at least under the first P.S.C. (the Libra P.S.C.), it is not

envisaged a government share before the execution of the contract, and after

the execution, an eventual government share would be subject to the approval of

the contractors, which would assign part of their shares to the

government.

One important difference

between the concession agreements and the P.S.C.s is that the signature bonus

in relation to the latter is determined in advance by the P.S.C., so it’s not

one of the criteria used to establish the winners of the bidding rounds. The

Brazilian P.S.C.s are granted on the basis of the offered highest share of

profit oil (as a function of the Brent price and the envisaged daily production

per producing well) given to the government; this is the only criteria used.

Law 12,351 created a

social fund for social and regional development. In specific, it will be used

for combating poverty, developing education, culture, sport activities, public

health, science and technology, and the environment. In addition, the social

fund should provide long-term savings ready to stabilize fluctuations in income

and prices for that part of the national economy linked to petroleum operations

(volatility, finiteness and a relevant impact on a national economy are the

three main characteristics of petroleum activities).

Apart from the Libra

field, which will be analyzed in detail below, until now all the pre-salt areas

under development have been directly assigned to Petrobras. In fact, through

the Transfer of Rights Agreement of 2010, the government gave Petrobras the

right to explore and produce 5 billion b.o.e. from six pre-salt areas in the

Santos Basin. Later in 2014, the government gave Petrobras the right to produce

surplus volumes estimated at 9.8 to 15.2 billion b.o.e.

PART I — Doubts About What Petrobras Can Do and What It

Cannot Do

Also if the oil price

were higher and Petrobras were not involved in any corruption scandal, there

would be some doubts as for Petrobras’ proficiency in implementing projects as

complex as those related to the pre-salt fields. In fact, the company may not

have the required financial and human resources. Moreover, given its size, the

company could not be well suited for the development of some small pre-salt

projects, which, instead, an independent more agile producer could bring

forward in an efficient way. Another danger for Petrobras could be its minimum

30 percent interest because it’s sufficient that a specific deposit gives a

less positive return on investment (R.O.I.) in order to produce relevant losses

to Petrobras. For more information about Petrobras and corruption, please refer

to the four slides “Operation Car Wash” above.

PART II — The Libra Field P.S.C. — A General Description

In October 2013, the government

of Brazil concluded its first, and until today unique, pre-salt licensing

round. This bidding round was about the Libra field (1,550 square kilometers),

located in the Santos Basin at a water depth of around 2,000 meters and

estimated to hold 8 to 12 billion barrels of recoverable oil — according to the

Ministry of Mines and Energy there should be 120 billion cubic meters of

natural gas as well. The A.N.P. would like to obtain a production target of at

least one million bbl/d.

Despite 11 companies had

confirmed their interest in the auction, only one consortium participated in

the bidding, and consequently it won. Many world top-class players with

reference to deep-water operations were absent — for instance, British

Petroleum, ExxonMobil and Chevron. In addition, there was the idea that there

could have been at least a couple of consortiums where Asian companies would

have owned a relevant part of the shares. In general, when in an auction there

is a single bid only, it is not a good sign for the organizing country, because

it has probably missed out on the power of a real competitive auction to raise

more economic resources to the government.

Under the terms of the

auction, Petrobras was supposed to be a partner with at least a 30 percent

stake in every participating consortium while the consortium had to guarantee

at least 41.6 percent of profit oil to the government (for an oil price between

$100 to $120 a barrel and a production per well of 10,000 bbl/d to 12,000

bbl/d). It was envisaged a signature bonus of $6.5 billion.

Five companies are part

of the winning consortium. They are:

- Petrobras (40 percent)

- Royal Dutch Shell (20 percent)

- Total (20 percent)

- China National Petroleum Corporation (C.N.P.C.) (10 percent)

- China National Offshore Oil Corporation (Cnooc) (10 percent)

Indeed, it’s a

challenging composition. Apart from Petrobras, which has to be a participant in

every Brazilian P.S.C., on the one side there are two European supermajors,

Royal Dutch Shell and Total, which are completely business-oriented companies,

while on the other side there are two Chinese government companies, C.N.P.C.

and Cnooc, whose primary goal is to have access to new petroleum resources on

behalf of the Chinese government.

PART II — The Libra Field P.S.C. — Building a Correct Analytical Framework

The table below shows a

SWOT analysis for the Libra field performed by Ernst and Young.

This SWOT analysis

captures the environment of the Libra field, but it’s too general, as a SWOT

analysis many times is. In fact, there are no coherent economic principles

underlying it. In practice, a SWOT analysis turns out to be too often a biased

list of items. Summing up, this SWOT analysis may be a good starting point, but

then a different analysis should be performed.

Indeed, negotiating a

fair and balanced petroleum contract between a government and a company or a

consortium of companies is never a simple exercise. In fact, there are many

variables involved (the most important of which is always the price of oil) and

the contract has to last for several decades — with reference to the Libra

field for 35 years. In other words, it’s quite possible that the contract may

provide both sides with a positive economic result in year X, while instead the

contract could be completely unacceptable to one of the two parties in year Y —

for instance, if, in year Y, one side is reaping windfall profits, while the

other side does not get similar positive results. And when a party is

dissatisfied with the result, the continuation of a contract is not simple.

Although it’s not a desired outcome, the parties may be forced to a contract

renegotiation, which is always a lengthy and complicated task. The worst case

scenario is the government nationalization of the petroleum sector or of a

specific company or project. This type of legal outcome has occurred several

times since the beginning of the petroleum industry; recently it’s worth

mentioning the case of the renationalization of YPF in Argentina.

With reference to a

business activity, and the petroleum sector is no exception, the real starting

point has to be the basic formula:

PROFITS = PRICE – COSTS

In a petroleum contract,

it’s important that the government and the I.O.C.s work always with the goal of

doing profits. Sometimes governments, in light of their public role, may

implement business operations where profitability is directly missing. But at a

careful assessment, the missing profitability is compensated by public good

gains in other sectors, so that we may speak of an indirect profitability. With

reference to the Libra field, the necessity to the government of obtaining

profits is reinforced by the presence of Petrobras (40 percent share in the

project, the operator of the consortium), which is under a 6o percent total

government ownership (direct and indirect). And, Petrobras has a working

participation because it contributes its share of costs since the beginning of

the operations, so Petrobras should focus its attention on making profits.

In order to understand

the profitability of an oil project, the first step is to delineate a pre-tax

cash flow analysis (based on certain economic assumptions) as exemplified by

the following formula:

REVENUES — EXPLORATION COSTS — DEVELOPMENT COSTS —

SUSTAINING CAPITAL — COST OF GOODS SOLD — SG&A COSTS — DECOMMISSIONING

COSTS

=

NET CASH FLOW BEFORE TAXES

For an I.O.C. it’s quite logic that net cash flow before

taxes need to be positive in order to barely start thinking of going ahead with

a petroleum project. The slide below developed by Alistair Watson and OpenOil

shows an invented example of a petroleum net cash flow before taxes.

According to who

performs the analysis there could be different names in relation to the costs

categories, but the logic of the costs components is always the same.

Once obtained the net

cash flow before taxes, it is necessary to add to this value the fiscal

parameters required by the country’s laws. Without inserting the fiscal

parameters, net cash flows before taxes, although positive, are completely

useless.

In the case of the Libra

field, the necessary fiscal parameters are:

- Royalty — A 15 percent fixed royalty with reference to the production value.

- Cost Oil Recovery Limit — The contractors are entitled to recover cost oil on a monthly basis: 50 percent of the gross amount of production during the first two years and 30 percent in the subsequent years. Under the current provision there will be no adjustment for inflation on the balance of cost oil account.

- Government Share of Profit Oil — 41.6 percent minimum profit oil share variable according to a sliding scale table based on the price of oil and production per well. This is a progressive tool.

- Income Tax — 34 percent on the cost oil and profit oil income of the contractor.

- Depreciation of Development Costs — It could be correct to assume a depreciation between 5 to 10 percent in line with industry trends.

- State Participation — Not present at the moment.

Once we add the fiscal

parameters, it’s likely to have a better idea of the profitability of the

project, but there are still two important parameters missing:

- Time Value of Money and

- Risk.

The net cash flow before

taxes formula may be calculated as a Single Period Model or as an Annualized

Model. The latter can evaluate the timing of the cash flows and then apply a

discount rate in order to calculate the Net Present Value (N.P.V.) and the

Internal Rate of Return (I.R.R.). In fact, money received or paid at different

times is like different currencies, so to put together cash flows occurring at

different timeframes, it’s necessary to apply a Discount Rate, i.e., the Rate

of Return (R) offered by investment alternatives in the capital markets of

equivalent risks. The Net Present Value Rule says to accept all project with

positive N.P.V. and to reject all the project with negative N.P.V. The Internal

Rate of Return of a project is the one discount rate such that the net present

value of the project’s free cash flows equals zero. The I.R.R. Rule says to

accept all projects whose I.R.R.>R and to reject all projects whose

I.R.R.<R.

One final necessary

calculation is to include in the analysis the Expected Net Present Value

(E.N.P.V., a.k.a. Expected Monetary Value, E.M.V.). In fact, the above

calculations have assumed that the exploration is successful, but drilling

success rates for offshore projects are in the order of 10 to 20 percent. A

company has to carry out an E.N.P.V. calculation, which is obtained through the

following formula:

E.N.P.V. = (Discounted N.P.V.)  (Percentage of Success) — (Minimum Exploration

Costs)

(Percentage of Success) — (Minimum Exploration

Costs)  (Percentage of Failure)

(Percentage of Failure)

If the

result of the above formula is negative, the project does not have to go ahead.

Only at this point, it’s

possible to have an idea whether the project may make economic sense or not.

But, of course, it is recommended that companies carry out a thorough

sensitivity analysis with reference to the most central parameters, of which

the most important is the oil price. It’s quite evident that if the price of a

barrel of oil is $100 is one thing, while if the price of a barrel of oil is

$90, $70, or $50 is another thing as for the economic performance of a project.

Similarly, estimates of

the total Libra field size are between a minimum of 4 billion barrels and a

maximum of 15 billion barrels. It’s probable that total production could range

between 5 billion barrels and 12.5 billion barrels. Another big question mark

is the number of required wells (some are producing wells while some others

have to inject water) and their productivity (from less than 4,000 barrels to

more than 24,000 barrels a day).

Summing up, the

proposed methodology, consisting of five consecutive analytical steps, i.e.,

net cash flows before taxes, fiscal parameters, N.P.V. & I.R.R., E.N.P.V

and sensitivity analysis, is a good procedure to evaluate whether a project is

profitable because it permits analysts to develop several different scenarios

changing the various parameters.

PART II — The Libra Field P.S.C. — Additional Parameters

Under the first presalt production sharing

agreement, the government set the local content requirement for the Libra field

at:

- 37 percent in the exploration phase,

- 55 percent in the development phase, and

- 59 percent after 2022.

The contractors are requested to purchase as much as

65 percent of their goods and services from Brazilian companies. The thresholds

mentioned above are indeed very high, and, over the last years, the I.O.C.s

working in Brazil have complained about the country’s lack of domestic capacity

to meet these requirements. This will be even more difficult with the

exploration and development of the pre-salt fields with their complicated

technicalities (ultra-deepwater fields want sophisticated technology, which is

not always present in Brazil, although the country has a relevant experience

drilling in deep and ultra-deep water). Local corruption adds to the already

complicated local content requirements and adds up to costs overruns and

project delays.

An additional point to remember is that in Brazil the marketing

of oil, natural gas and their derivatives is completely free. In other words,

the companies may either sell oil, gas and their derivatives in the domestic

market or export them — the only exception is linked to emergency situations

that require to use all of the production domestically.

The Libra P.S.C. set four different types of contractual

guaranties:

- Performance bond

- Bid bond ($67.7 million)

- Exploration activity financial bond ($264.9 million), whose goal is to ensure a payment in case the contractors fail to perform the minimum exploration program set for this contract.

- Deactivation bond, whose goal is to ensure that there will be enough funds to carry out all the operations for deactivating and closing the fields.

PART II — The Libra Field — Drawing Some

Initial Considerations

The goal of the paper is to provide some

indications as for a valid model in order to assess the viability of investing

in the Libra field. The proposed methodology, consisting of five consecutive

analytical steps, i.e., net cash flows, fiscal parameters, N.P.V. & I.R.R.,

E.N.P.V, and sensitivity analysis, is the correct procedure to have a clear

picture of the possible different outcomes of the Libra project. The next step

will be to develop an annualized model. Of course, if all the data are publicly

available or if it is possible to have some reliable estimates for certain

parameters.

But, it’s already possible to draw some initial

basic considerations with reference to the Libra P.S.C. Among them:

- First of all, according to Brazil’s P.S.C. framework, the general new rules are indeed economically dangerous for Petrobras. In fact, according to law, in the pre-salt areas, the Brazilian company has to get at least a 30 percent stake in all the winning bids. In other words, unless the company has an active role in the auction, it will not have a say with reference to the terms the other bidders have committed to. In the Libra field auction, the fear was that the Chinese companies were more interested in accessing crude oil than in negotiating a low price. For sure, Petrobras would have found the first option quite unacceptable (expensive).

- The profit oil table is a progressive tool in favor of the government, which gets a better profitability with higher oil prices and an improved well productivity. The minimum bid profit is 41.65 percent with an oil price between $100 to $120 per barrel and a well productivity of 10,000 bbl/d to 12,000 bbl/d. If the oil price is lower (higher) and well productivity is lower (higher), a fixed percentage, as defined by the table, is subtracted (added) from (to) the basic percentage of profit oil. Summing up, the lowest value in relation to the government profit oil is 15 percent while the highest value is 45.56 percent. What immediately emerges is that under low oil prices and low well productivity, the reduction in the percentage points of the profit oil to the government is quite consistent, and this means that the government assumes too much risk under a scenario of low oil prices and low well productivity. Under this scenario, it’s quite probable that companies will drill more wells than necessary.

- A signature bonus of $6.5 billion is very high for the industry standards. It’s a very regressive tool, and it creates a relevant distortion because it’s not recoverable for production sharing purposes; it’s equivalent to borrowing at a very high interest rate for no real need. The two charts below by Pedro van Meurs and Marcelo de A. Sampaio show that while the government take with and without the bonus signature is practically the same across all the ranges of oil prices, the I.R.R. changes consistently. The I.R.R. without the bonus is 4 percent higher with low oil prices and 13 percent higher with high oil prices. Indeed, it’s an important distortion. Van Meurs and Sampaio point out that two good alternatives could have been to avoid the bonus and to increase the minimum profit oil percentage to the government or to avoid the bonus and to introduce a Special Participation Tax, which is a progressive tool. Both alternatives would have generated more profits to the government, in particular the special participation tax. They calculate that at $100 a barrel, canceling the signature bonus and introducing a higher minimum bid or a special participation tax would have resulted in 41 billion dollars or $55 billion dollars more of revenues, respectively. Once a bonus is paid, the I.O.C.s rightly consider it a sunk cost; the I.O.C.s pay the bonus, but, then, the remaining government take will be lower in comparison to the international financial standards.

Moreover, the present price of oil, Petrobras’

current corruption scandal, and Petrobras’ lack of financial resources do not

help the development of Brazil’s offshore fields. In specific, with reference

to the price of oil, it’s worth to underline that oil price always fluctuates,

continuously passing through different cycles, so it’s quite normal that, over

the life of a petroleum project, there will be periods of high oil prices and

periods of low oil prices (oil and gas are commodities). Honestly, it is

unthinkable to have the same oil price for all the duration of an oil project.

With reference to the lack of financial resources, Brazil is currently

struggling to find a solution. Parliament is discussing a bill that could

change part of Law 12,351, which requires Petrobras to always be the lead

operator with at least a 30 percent share in a P.S.C. The modified law would

give Petrobras the right of refusal to control and drill each field before the

organization of an auction. The idea is to attract fresh capital from foreign companies,

which, as a consequence of the bill, could be the operator, and exempting

Petrobras from heavily borrowing financial resources. Still on the same track,

in December 2015, rumors affirmed that Petrobras wanted to sell a quarter of

its 40 percent stake in the Libra field with the goal of reducing its debt,

although later the company denied this possibility.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.